Let’s start with the bad news: about UAH 8 billion a month is being laundered through Drop Cards, leading to annual losses of at least UAH 10 billion to Ukraine’s State Budget.

We are talking about shadow transactions conducted through so-called Drop Cards. The estimate of UAH 8 billion per month applies only to the illegal gambling business. In total, Drop Cards account for UAH 100 billion per year in illegal transactions, leading to at least UAH 10 billion a year in potential losses in budget revenues. It is time to fix the problem, because Drop Card channels serve not only the illegal gambling business, but also other shadow payments.

The National Bank of Ukraine estimates the volume of gambling business in Ukraine at UAH 12-15 billion per month (payments under MCC code 7995 - gambling). The effective tax burden on the industry (white segment) is about 10% of the turnover. At the same time, market leaders confirm that currently 40% to 50% of the gambling market continues to be in the shadows (accounting for an average UAH 12 billion per month). The main instrument of the financial infrastructure of illegal online casinos (about 70%) is Drop Cards.

The drop mechanism works thanks to the financial ignorance of ordinary Ukrainian citizens and the creativity of shadowy businessmen, whose minions look for — and easily find — people who agree to "rent" a card opened in a bank for a certain fee. In exchange, the person, in whose name the card is opened, receives about UAH 10,000-14,000 per month, although in difficult circumstances, people are willing to settle for much smaller amounts

Hundreds and even thousands of payments are accepted per month through one Drop Card, totaling hundreds of thousands of hryvnias. This is quite a serious business. Entire networks of Drop Cards exist. Some are used to accept bets or replenish deposits in illegal online casinos. These funds are then either received in cash or transferred to other accounts.

Danger from "drops" is real

We insist that this tool – Drop Cards – is extremely dangerous.

First, it is dangerous for the State Budget, which is deprived of tax revenues.

Secondly, it is dangerous for the financial system, because "drops" actually play the role of "washing machines," which launder dirty funds.

Thirdly, it is dangerous for those careless citizens who provide their documents or payment cards "for rent" for financial abuse, if only because these citizens are in for serious trouble, including valid questions from the tax office to accusations of facilitating money laundering.

How to deal with with Drop Cards

You can chase down and punish the organizers and participants of these schemes, which are not the most popular in the field of illegal online gambling business, but it is much more effective to introduce special measures that will make the this scheme economically unprofitable.

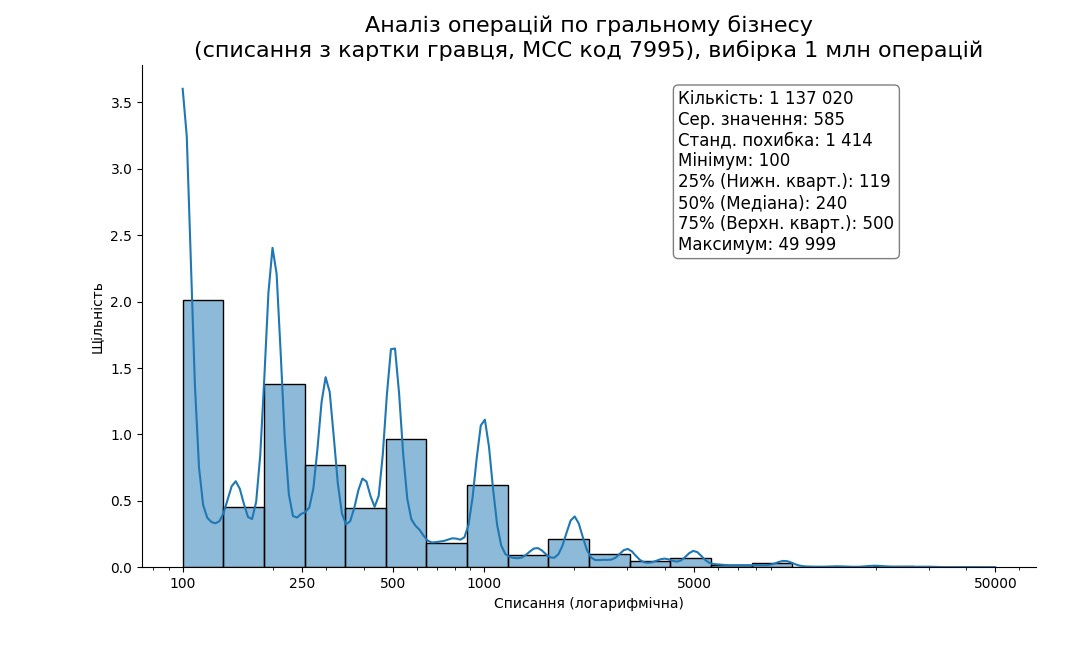

Our research revealed some interesting facts and figures. We processed data on approximately one million transactions conducted by a legal online casino. Most likely, the structure of operations in illegal casinos is almost the same. The study showed that the average amount of payment from a player to an online casino, i.e. replenishment of a gaming deposit or bet, is approximately UAH 600* hryvnias at a time, and the average prize fund payment is about UAH 2,600.

Source: impersonal data of banks (more than three in total), the share of each of which does not exceed 50% of the total sample, for the period 2022-2023.

As already mentioned, the cost of "renting" a Drop Card is approximately UAH 10,000-14,000 on average in this strange "market." The acceptable level of costs for organizing the acceptance and payment of illegal payments in this market is considered to be about 12-14% for the "deposit acceptance - prize payment" circle.

A fairly simple calculation shows that such a scheme remains economically profitable if 120 payments per month or more are received from players on the illegal gambling market per Drop Dard. In fact, hundreds of payments per day are usually accepted on one card. That is, if you make it so that it is impossible to accept more than a hundred payments per month on an ordinary card of an individual, then the Drop Card problem will disappear.

What is the solution?

We must answer two main questions:

How to monitor the fulfillment of this limit on the number of incoming transfers to the card - one hundred incoming transfers per month?

Who will monitor violations of the above limit?

First, let’s take a deep breath, calm down and look at the situation from the perspective of real life. Think about the following proposition: bank cards receiving a hundred or more transfers per month will be temporarily blocked until we receive an explanation from the owner. Think about this. Will this include only citizens who gave their cards for "rent?"

Ordinary adults who live normal lives receive a dozen or so incoming payments per month on their banking cards, and even that is a lot. Does a person sell his personal things through the OLX [on-line market place]? Maybe, but not several dozen times a week. Receives transfers from friends on your card for a birthday or wedding? Also hardly more than a few dozen at a time.

Yes, here we are dealing with possible problems with volunteers who collect funds not for charity, but for their personal enrichment. But we must remember that with volunteer contributions to a personal account there is a risk of receiving questions from the tax office. In this case, it should be possible to register bank account or card as a “volunteer account.” Of course, if the account or card has volunteer status, the limits should not apply to them.

There may be objections from people who are engaged in small businesses or from the self-employed, that is, from taxi drivers and tutors, nannies and cleaners, craftsmen and hairdressers. For these card holders, specified limits on the number of transactions per month will not create problems.

Each bank is easily able to monitor the number of incoming transfers to its client's card. Moreover, without manual labor costs. For this, banks already use special special programs that are used for marketing purposes and for card security.

There is also Derzhfinmonitoring (State Financial Monitoring Office), the state agency to which banks submit information about suspicious transactions and can even temporarily block such accounts through which these transactions took place. If this agency decides that the received message really signals possible laundering of dirty funds, it must even notify the relevant law enforcement agencies.

Banks determine the suspiciousness or riskiness of transactions on the basis of certain signs that they formulate themselves, as well as using the relevant guidance documents of the National Bank of Ukraine and Derzhfinmonitoring. To introduce a limit of, say, 100 incoming transfers per month, it is not even necessary to adopt a special law, because the current legislation is sufficient.

But we understand that such a system will work only in the event that criminals take only one card for "rent" from a certain person. Then this business is economically unprofitable for them, because it will not be possible to pump a significant number of transactions through such a card due to the limit.

But what can we do when someone "rents" his passport and individual tax number? Then criminals can open numerous accounts in many banks and issue dozens of payment cards. This case is much worse in the sense of tracing, but not hopeless.

Even 60-70 incoming transfers per month is on the border of rational behavior of an ordinary individual who does not use his account for earnings. But it is probably not worth it to block under such conditions right away. Here, asking the cardholder from the bank about the purpose of such financial behavior is a would be helpful, because the individual will be asked by bank for an explanation and will be informed about the risks of such behavior. But, in the end, they will simply report the volume and number of transactions, which such a card "lessor" may not even know about.

If it comes to the logical end, then the bank can also report strange behavior to the Derzhfinmonitoring without blocking the account. If by that time the agency will already have at least half a dozen similar reports about such a person from other banks, this can definitely be a signal for a thorough investigation. And it is very easy to compare messages from different banks about atypical activity of card holders using individual tax numbers.

These proposed remedies, of course, are not the only possible ones. But they are definitely acceptable as a basis for creating an effective and cheap system of measures.

Ukraine’s Drop Card problem is serious, expensive and sensitive. It should be solved urgently. The methods of solution should be extremely delicate and not affect ordinary users of banking services at all. Opportunities to address this problem exist within the existing system of supervision over banks and other financial institutions and the financial monitoring system.

Bohdan Dovzhenko, Treasury Department Director, FC MANI REPUBLIC LLC

Hryhoriy Kukuruza, economist at Ukraine Economic Outlook

(This article appeared in Interfax-Ukraine on April 16, 2024 in the Ukrainian-language original)